Condo Insurance in and around Fort Worth

Here's why you need condo unitowners insurance

Condo insurance that helps you check all the boxes

There’s No Place Like Home

Committing to condo ownership is a big responsibility. You need to consider needed repairs neighborhood and more. But once you find the perfect condominium to call home, you also need terrific insurance. Finding the right coverage can help your Fort Worth unit be a sweet place to call home!

Here's why you need condo unitowners insurance

Condo insurance that helps you check all the boxes

Why Condo Owners In Fort Worth Choose State Farm

Your home is more than just a roof and four walls. It's a refuge for you and your loved ones, full of your personal items with both sentimental and monetary value. It’s all the memories you’ve made there. Doing what you can to help keep it safe just makes sense! That's why one of the most sensible steps is getting a Condominium Unitowners policy from State Farm. This protection helps cover a wide range of home-related accidents. For example, what if a gas leak causes a fire or an intruder steals your tablet? Despite the annoyance or disappointment from the experience, you'll at least have some comfort knowing your State Farm Condominium Unitowners policy that may help. You can work with Agent Camilla Harris who can help you file a claim to help assist covering the cost of your lost items. Preparing doesn’t stop troubles from finding you. Coverage from State Farm can help get your condo back to its sweet spot.

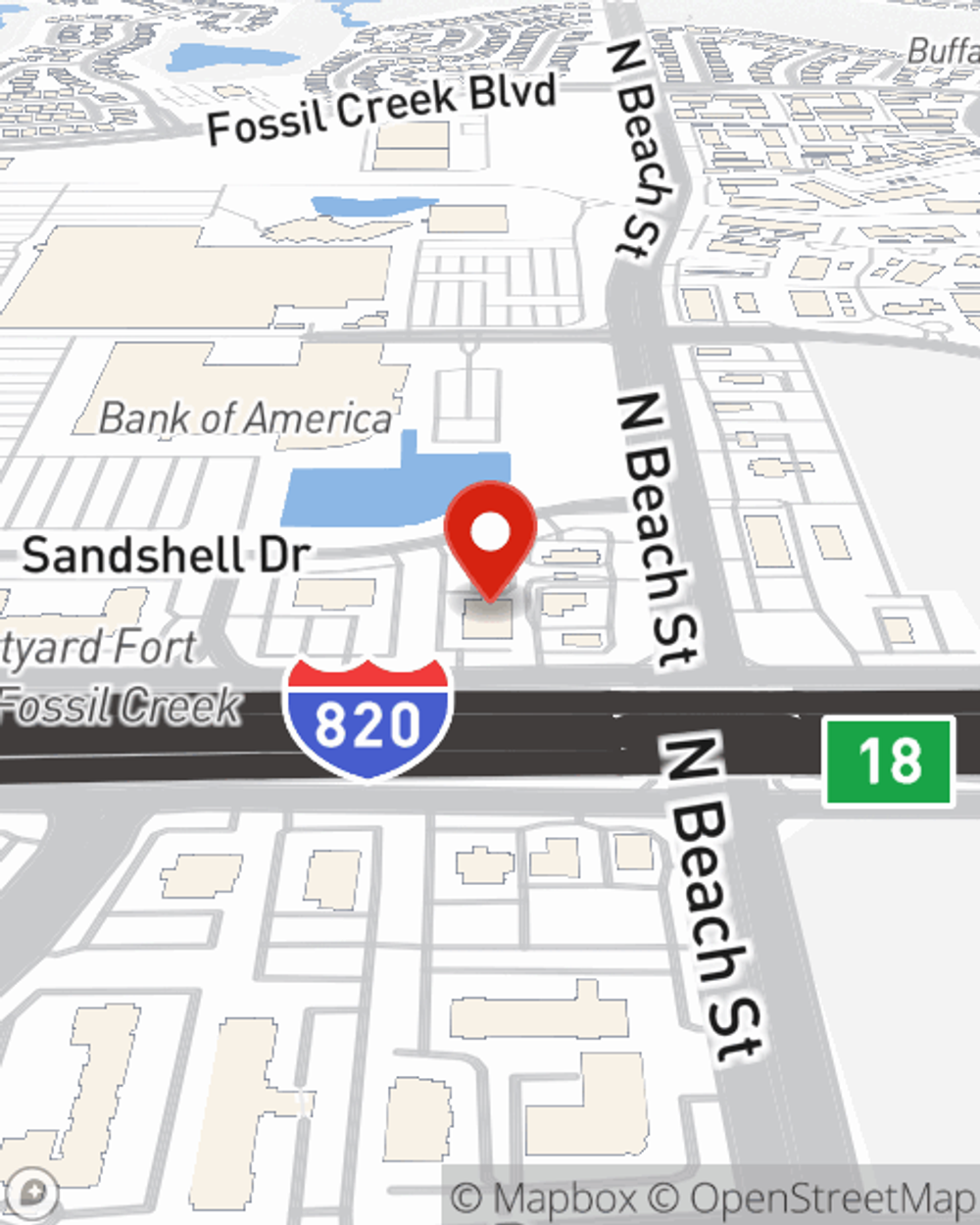

Getting started on an insurance policy for your condominium is just a quote away. Stop by State Farm agent Camilla Harris's office to discover your options.

Have More Questions About Condo Unitowners Insurance?

Call Camilla at (817) 306-6188 or visit our FAQ page.

Simple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.

Camilla Harris

State Farm® Insurance AgentSimple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.